Apartment

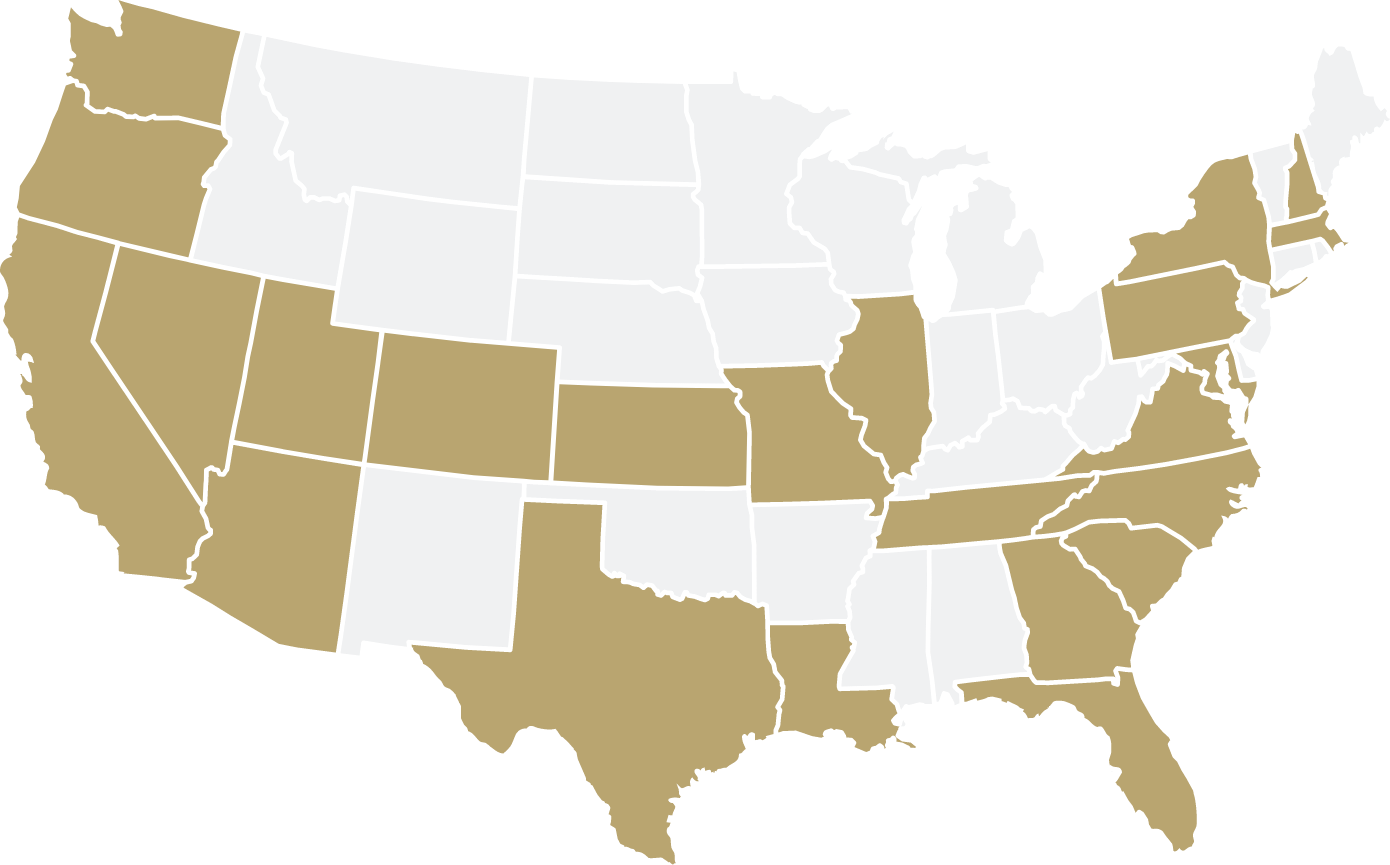

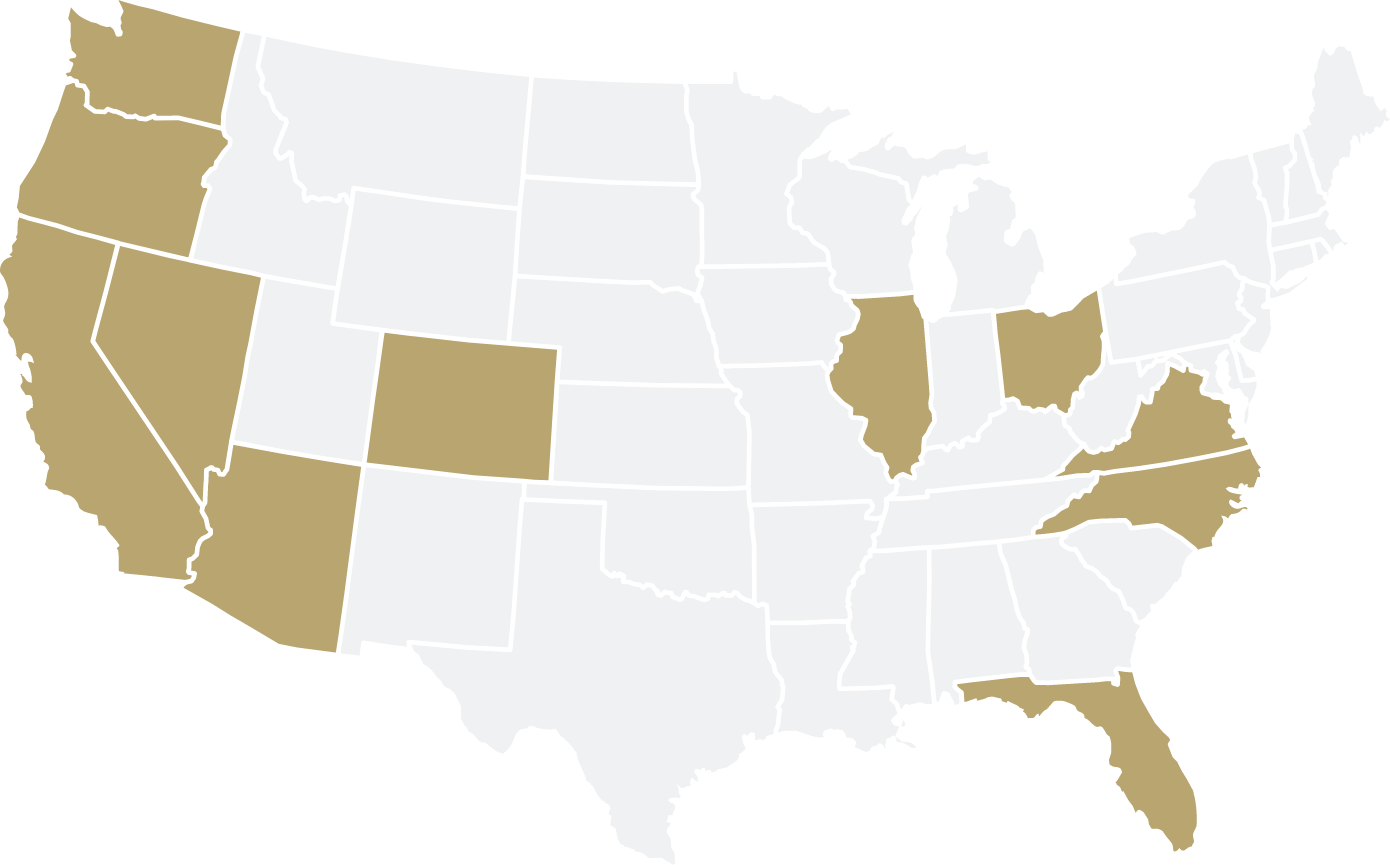

Crow Holdings Capital believes the rental housing sector is well-positioned due to demographic trends and affordability concerns in the single-family market. Crow Holdings’ on-the-ground presence and hands-on capabilities help the team acquire and develop well-located properties in primary and secondary markets, particularly in the Sunbelt markets, where employment and population growth are strong. By strategically investing in the multifamily sector as part of the team’s Housing Strategies and aligning our efforts with these demand drivers, we aim to contribute to the growing need for attainable and high-quality housing options in the market.

Demand Drivers:

- Housing unit supply shortfall

- Increase in homeownership costs

- Delayed marriage, emphasis on life experiences, and rising student debt levels

- Significant delays in construction starts

Industrial

The industrial sector has been a pillar of Crow Holdings since its founding in 1948, when Trammell Crow first built speculative warehouse space in Dallas. Over the years, Crow Holdings has developed relationships and partnerships in multiple markets, and Crow Holdings Capital has continued to capitalize on the secular trends in the U.S. logistics sector. E-commerce continues to fuel demand for industrial space, along with the importance of supply chain management and prominence of near- and onshoring. The team targets opportunities located in primary industrial markets that offer strong labor characteristics, diverse sources of tenant demand, and population density.

Demand Drivers:

- E-commerce

- “Just in case” inventory

- Onshoring / nearshoring manufacturing

- Flight to quality

Specialty

Manufactured Housing, Student Housing, Self-Storage, Food & Service Retail, Convenience & Gas

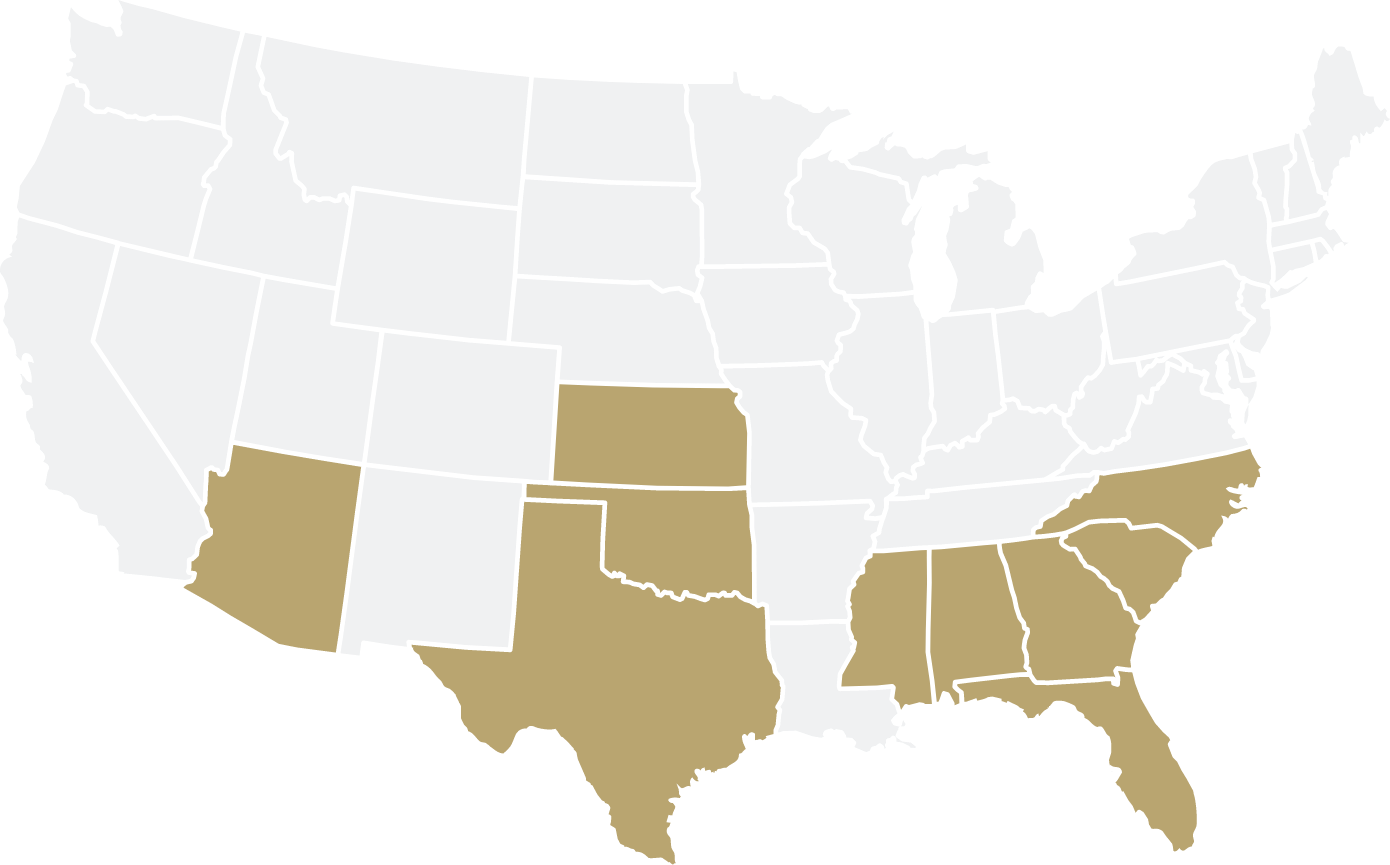

In addition to targeting industrial and multifamily assets, Crow Holdings Capital seeks to bring institutional ownership to fragmented, specialty asset classes with growing demand and reduced correlation to market cycles, including self-storage, manufactured housing, student housing, food & service retail, and convenience & gas.

Demand Drivers:

- Needs-based demand

- Recession and inflation resistant

- Low operating cost

- Fragmented ownership

Demand Drivers:

- Supply and demand imbalance

- Stable cash flows

- Fragmented ownership

- Operational inefficiencies

Demand Drivers:

- Enrollment growth

- Bed-to-bath parity

- Proximity to campus

Demand Drivers:

- E-commerce resilience

- Food and service tenancy

- Fragmented ownership

- Location

Demand Drivers:

- Needs-based demand

- High-traffic locations

- Reliable cash flows